Cybersecurity firm Darktrace accepts $5 bn takeover

Cybersecurity firm Darktrace said Friday it had accepted a $5.3-billion takeover bid from US private equity firm Thoma Bravo, which highlighted the British group's "capability in artificial intelligence".

The cash bid comes after Thoma Bravo expressed takeover interest two years ago.

"Darktrace is at the very cutting edge of cybersecurity technology, and we have long been admirers of its platform and capability in artificial intelligence," Thoma Bravo partner Andrew Almeida said in a statement.

"The pace of innovation in cybersecurity is accelerating in response to cyber threats that are simultaneously complex, global and sophisticated."

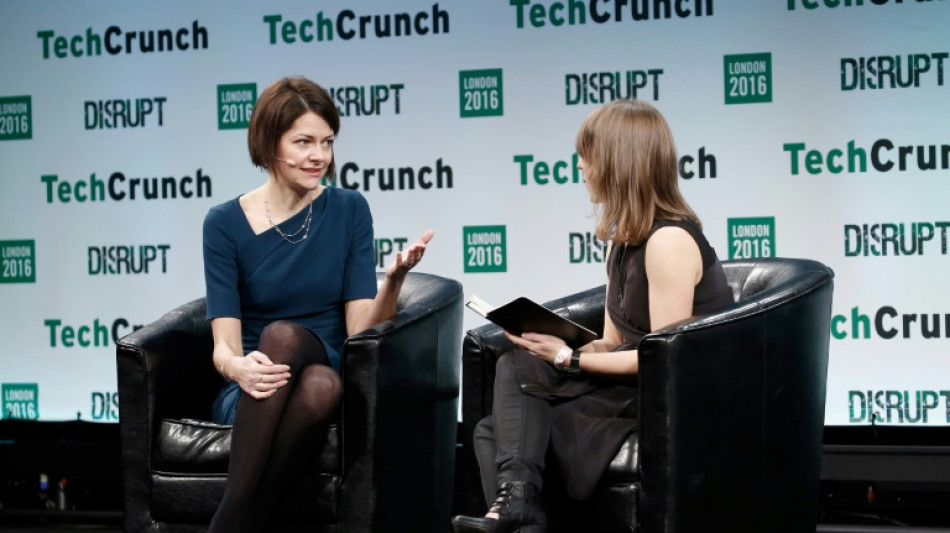

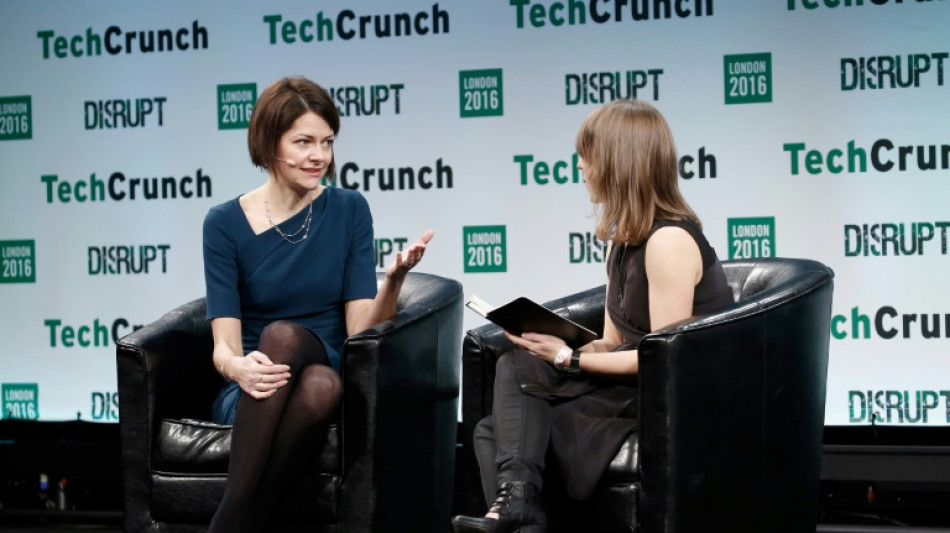

Darktrace chief executive Poppy Gustafsson said the group's "technology has never been more relevant in a world increasingly threatened by AI-powered cyberattacks".

Darktrace, headquartered in the university city of Cambridge close to London, floated on the London stock market in 2021.

The cash deal announced Friday is worth $7.75 dollars per Darktrace share -- a 44 percent premium on the group's average share price in the last three months, according to Thoma Bravo.

Following the announcement, the share price surged 18 percent to 612 pence ($7.7).

Created in 2013, Darktrace employs more than 2,300 people around the world.

"The proposed acquisition will provide Darktrace access to a strong financial partner in Thoma Bravo, with deep software sector expertise, who can enhance the company's position as a best-in-class cyber AI business headquartered in the UK," Darktrace chair Gordon Hurst said in the statement.

The pair hope to complete the deal in the second half of the year thanks to shareholder and regulatory approval.

Almeida noted that Thoma Bravo has invested "exclusively in software for over twenty years" which would allow it to bring "operational expertise and deep experience of cybersecurity in supporting Darktrace's growth".

Prior to Friday's announcement, shares in Darktrace has bounced back strongly after the company was cleared by independent auditors EY of having irregularities in its accounts.

Explaining its decision to go private, Darktrace said its "operating and financial achievements have not been reflected commensurately in its valuation with shares trading at a significant discount to its global peer group".

- Takeover boom -

The bid comes at the end of a week in which the London stock market has been gripped by takeover activity, helping the top-tier FTSE 100 index to record highs.

British mining giant Anglo American on Friday rejected a blockbuster $38.8-billion takeover bid from Australian rival BHP, slamming it as "highly unattractive" and "opportunistic".

A battle to buy UK music rights owner Hipgnosis Songs Fund meanwhile took a fresh twist after US rival Concord increased its takeover offer, slightly beating a bid by Blackstone.

Concord on Wednesday offered $1.5 billion for Hipgnosis, whose catalogue includes Justin Bieber, Shakira and Neil Young.

This is more than its original $1.4 billion offer that preceded a higher bid from US asset manager Blackstone.

P.Russo--IM